-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

-

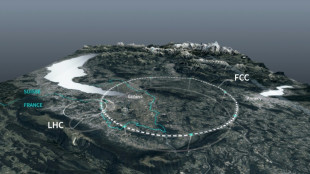

Private donors pledge $1 bn for CERN particle accelerator

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

Not enough evidence against Swedish PM murder suspect: prosecutor

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

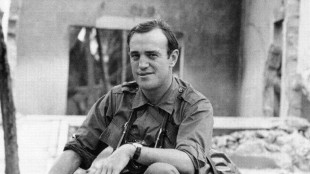

Pulitzer-winning combat reporter Peter Arnett dies at 91

-

EU kicks off crunch summit on Russian asset plan for Ukraine

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Lyon humbled to surpass childhood hero McGrath's wicket tally

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

England vow to keep 'fighting and scrapping' as Ashes slip away

-

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

-

Most Asian markets track Wall St lower as AI fears mount

-

Cambodia says Thailand bombs casino hub on border

Cambodia says Thailand bombs casino hub on border

-

Thai queen wins SEA Games gold in sailing

-

England Ashes dreams on life-support as Australia rip through batting

England Ashes dreams on life-support as Australia rip through batting

-

Masterful Conway, Latham in 323 opening stand as West Indies wilt

-

Danish 'ghetto' tenants hope for EU discrimination win

Danish 'ghetto' tenants hope for EU discrimination win

-

Cricket Australia boss slams technology as Snicko confusion continues

IMF urges Swiss to strengthen bank resilience

The International Monetary Fund on Tuesday urged Switzerland to strengthen the resilience of its banks and address the flaws exposed by the collapse of Credit Suisse.

The IMF said the Swiss Financial Market Supervisory Authority (FINMA) ought to be able to intervene early to detect and address bank failures, including having the power to impose fines, conduct on-site inspections, or intervene to improve risk management.

"Enhanced legal powers and resources for FINMA are critical to strengthening the effectiveness of supervision," the IMF said as it presented the findings of an analysis of the Swiss financial sector.

Credit Suisse, Switzerland's second-biggest bank, was among 30 international banks deemed too big to fail due to their importance in the global banking architecture.

But it imploded in March 2023, with the Swiss government, the central bank and FINMA strongarming the country's biggest bank UBS into a quickfire $3.25-billion takeover.

The government feared Credit Suisse would have rapidly defaulted and triggered a global banking crisis that would also have shredded Switzerland's valuable reputation for sound banking.

The government set about tightening regulations in the banking sector -- in particular to ensure that UBS can withstand a crisis, given the size of the megabank now, in relation to the Swiss economy.

Last month it unveiled its proposals, which included strengthening FINMA's powers and significantly increasing the capital that UBS will have to set aside for its foreign subsidiaries -- much to the bank's displeasure.

This could amount to nearly $18 billion of additional capital.

However, UBS argued that these requirements -- which are much more onerous than those in other countries -- risked putting it at a disadvantage compared to its competitors abroad.

The reforms, aimed at reducing the risks for the state, taxpayers and the economy, "would further strengthen the long-term stability of the Swiss financial centre", the IMF said.

The IMF found the Swiss financial sector would be broadly resilient in the event of a severe shock, but nonetheless needed strengthening given the current climate of high uncertainty in the global economy.

"Switzerland continues to benefit from strong fundamentals, highly credible institutions, and a skilled labour force, positioning it among the world’s most competitive, resilient, and innovative economies," the IMF said in a statement.

Nonetheless, it faces challenges from "persistent safe-haven pressures" and the appreciation of the Swiss franc currency, it said.

S.Keller--BTB