-

Australia's Head fires quickfire 68 as England's Ashes hopes fade

Australia's Head fires quickfire 68 as England's Ashes hopes fade

-

Conway falls for 227 as New Zealand declare at 575-8 in West Indies Test

-

Japan hikes interest rates to 30-year-high

Japan hikes interest rates to 30-year-high

-

Brazil's top court strikes down law blocking Indigenous land claims

-

Conway falls for 227 as New Zealand pass 500 in West Indies Test

Conway falls for 227 as New Zealand pass 500 in West Indies Test

-

'We are ghosts': Britain's migrant night workers

-

Asian markets rise as US inflation eases, Micron soothes tech fears

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Giant lanterns light up Christmas in Catholic Philippines

-

TikTok: key things to know

TikTok: key things to know

-

Putin, emboldened by Ukraine gains, to hold annual presser

-

Deportation fears spur US migrants to entrust guardianship of their children

Deportation fears spur US migrants to entrust guardianship of their children

-

Upstart gangsters shake Japan's yakuza

-

Trump signs $900 bn defense policy bill into law

Trump signs $900 bn defense policy bill into law

-

Stokes's 83 gives England hope as Australia lead by 102 in 3rd Test

-

Go long: the rise and rise of the NFL field goal

Go long: the rise and rise of the NFL field goal

-

Australia announces gun buyback, day of 'reflection' after Bondi shooting

-

New Zealand Cricket chief quits after split over new T20 league

New Zealand Cricket chief quits after split over new T20 league

-

England all out for 286, trail Australia by 85 in 3rd Test

-

Australian announces gun buyback, day of 'reflection' after Bondi shooting

Australian announces gun buyback, day of 'reflection' after Bondi shooting

-

Joshua takes huge weight advantage into Paul fight

-

TikTok signs joint venture deal to end US ban threat

TikTok signs joint venture deal to end US ban threat

-

Conway's glorious 200 powers New Zealand to 424-3 against West Indies

-

WNBA lockout looms closer after player vote authorizes strike

WNBA lockout looms closer after player vote authorizes strike

-

Honduras begins partial vote recount in Trump-dominated election

-

Nike shares slump as China struggles continue

Nike shares slump as China struggles continue

-

Hundreds swim, float at Bondi Beach to honour shooting victims

-

Crunch time for EU leaders on tapping Russian assets for Ukraine

Crunch time for EU leaders on tapping Russian assets for Ukraine

-

Pope replaces New York's pro-Trump Cardinal with pro-migrant Chicagoan

-

Trump orders marijuana reclassified as less dangerous drug

Trump orders marijuana reclassified as less dangerous drug

-

Rams ace Nacua apologizes over 'antisemitic' gesture furor

-

McIlroy wins BBC sports personality award for 2025 heroics

McIlroy wins BBC sports personality award for 2025 heroics

-

Napoli beat Milan in Italian Super Cup semi-final

-

Violence erupts in Bangladesh after wounded youth leader dies

Violence erupts in Bangladesh after wounded youth leader dies

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

US hosting new Gaza talks to push next phase of deal

US hosting new Gaza talks to push next phase of deal

-

Chicago Bears mulling Indiana home over public funding standoff

-

Trump renames Kennedy arts center after himself

Trump renames Kennedy arts center after himself

-

Trump rebrands housing supplement as $1,776 bonuses for US troops

-

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Trump signs order reclassifying marijuana as less dangerous

-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

US accuses S.Africa of harassing US officials working with Afrikaners

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

Assange files complaint against Nobel Foundation over Machado win

-

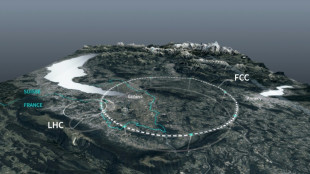

Private donors pledge $1 bn for CERN particle accelerator

Global stocks steady as US and Russia hold talks

Global stock markets held largely steady on Tuesday as top US and Russian diplomats held their first since Russia's invasion of Ukraine.

The talks, which excluded Europe and Ukraine, ended with Moscow and Washington agreeing to appoint teams to negotiate an end to the Ukraine war.

"Donald Trump continues to be the dominant force for financial markets," said Kathleen Brooks, research director at XTB.

"Trump has ripped up the playbook when it comes to dealing with Russia, and the markets are keeping the faith with the US President for now," she added.

In Europe, the main markets were mostly higher, with Frankfurt's DAX index striking another all-time high as elections approach, with investors hoping a ruling coalition better able to act will emerge.

Defence stocks mostly added to gains after having soared the previous day as European leaders held an informal summit to discuss Ukraine and signalled more financial and military support ahead.

Danish Prime Minister Mette Frederiksen said her government would announce plans later Wednesday for a "massive" rearming of Denmark's military due to the growing threat posed by Russia.

Wall Street opened mostly higher as traders came back from a three-day holiday weekend, with the S&P 500 falling just short of hitting a record high.

"Fittingly, gains in the mega-cap stocks, and AI enthusiasm following xAI's release of its Grok 3 model, are among the primary factors for the upside bias," said Briefing.com analyst Patrick O'Hare.

Shares in struggling chipmaker Intel rose more than six percent at the start of trading following reports that rivals Broadcom and TSMC could buy parts of its business.

Over in Asia, Hong Kong's stock market soared Tuesday, thanks to a recovery in Chinese tech stocks.

That came after a meeting between President Xi Jinping and China's top business leaders fanned hopes that a long-running crackdown on the private sector is coming to an end.

Since taking the helm, Xi has strengthened the role of state enterprises in the world's second-largest economy and waged crackdowns on some areas of the private sector.

The drive has hammered some of the country's biggest names in recent years, sending their share prices plummeting.

Monday's gathering provided some much-needed relief to investors and boosted hopes for a sector revival.

"This was seen as a strong signal that his crackdown on the tech sector is over and with forthcoming pro-business policies to help revive the economy," said National Australia Bank head of market economics Tapas Strickland.

Chinese tech and e-commerce giant Alibaba rose more than two percent. Games developer XD Inc surged more than 10 percent, while Tencent added two percent.

Shanghai's stock market fared less well, while Tokyo gained.

Sydney fell as the Reserve Bank of Australia announced its first interest rate cut since late 2020 but warned global uncertainties would make it hard for officials to follow up with any more anytime soon.

- Key figures around 1430 GMT -

New York - Dow: DOWN less than 0.1 percent at 44,513.12 points

New York - S&P 500: UP 0.1 percent at 6,122.62

New York - Nasdaq Composite: UP 0.3 percent at 20,080.99

London - FTSE 100: FLAT at 8,764.72

Paris - CAC 40: UP 0.2 percent at 8,202.31

Frankfurt - DAX: UP 0.1 percent at 22,828.41

Tokyo - Nikkei 225: UP 0.3 percent at 39,270.40 (close)

Hong Kong - Hang Seng Index: UP 1.6 percent at 22,976.81 (close)

Shanghai - Composite: DOWN 0.9 percent at 3,324.49 (close)

Euro/dollar: DOWN at $1.0455 from $1.0483 on Monday

Pound/dollar: DOWN at $1.2608 from $1.2613

Dollar/yen: UP at 151.76 from 151.41 yen

Euro/pound: DOWN at 82.93 pence from 83.11 pence

West Texas Intermediate: UP 1.1 percent at $71.53 per barrel

Brent North Sea Crude: UP 0.4 percent at $75.50 per barrel

burs-rl/yad

O.Bulka--BTB