-

TikTok signs joint venture deal to end US ban threat

TikTok signs joint venture deal to end US ban threat

-

Conway's glorious 200 powers New Zealand to 424-3 against West Indies

-

WNBA lockout looms closer after player vote authorizes strike

WNBA lockout looms closer after player vote authorizes strike

-

Honduras begins partial vote recount in Trump-dominated election

-

Nike shares slump as China struggles continue

Nike shares slump as China struggles continue

-

Hundreds swim, float at Bondi Beach to honour shooting victims

-

Crunch time for EU leaders on tapping Russian assets for Ukraine

Crunch time for EU leaders on tapping Russian assets for Ukraine

-

Pope replaces New York's pro-Trump Cardinal with pro-migrant Chicagoan

-

Trump orders marijuana reclassified as less dangerous drug

Trump orders marijuana reclassified as less dangerous drug

-

Rams ace Nacua apologizes over 'antisemitic' gesture furor

-

McIlroy wins BBC sports personality award for 2025 heroics

McIlroy wins BBC sports personality award for 2025 heroics

-

Napoli beat Milan in Italian Super Cup semi-final

-

Violence erupts in Bangladesh after wounded youth leader dies

Violence erupts in Bangladesh after wounded youth leader dies

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

US hosting new Gaza talks to push next phase of deal

US hosting new Gaza talks to push next phase of deal

-

Chicago Bears mulling Indiana home over public funding standoff

-

Trump renames Kennedy arts center after himself

Trump renames Kennedy arts center after himself

-

Trump rebrands housing supplement as $1,776 bonuses for US troops

-

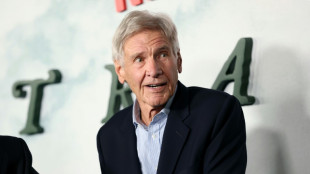

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Trump signs order reclassifying marijuana as less dangerous

-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

US accuses S.Africa of harassing US officials working with Afrikaners

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

Assange files complaint against Nobel Foundation over Machado win

-

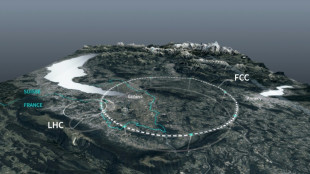

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

Asian markets extend gains as China-US talks head into second day

Asian stocks squeezed out more gains Tuesday as the latest round of China-US trade talks moved into a second day, with one of Donald Trump's top advisers saying he expected "a big, strong handshake".

There is optimism the negotiations -- which come after the US president spoke to Chinese counterpart Xi Jinping last week -- will bring some much-needed calm to markets and ease tensions between the economic superpowers.

The advances in Asian equities built on Monday's rally and followed a broadly positive day on Wall Street, where the S&P 500 edged closer to the record high touched earlier in the year.

This week's meeting in London will look to smooth relations after Trump accused Beijing of violating an agreement made at a meeting of top officials last month in Geneva that ended with the two sides slashing tit-for-tat tariffs.

The key issues on the agenda at the talks are expected to be exports of rare earth minerals used in a wide range of things including smartphones and electric vehicle batteries.

"In Geneva, we had agreed to lower tariffs on them, and they had agreed to release the magnets and rare earths that we need throughout the economy," Trump's top economic adviser, Kevin Hassett, told CNBC on Monday.

But even though Beijing was releasing some supplies, "it was going a lot slower than some companies believed was optimal", he added.

Still, he said he expected "a big, strong handshake" at the end of the talks.

"Our expectation is that after the handshake, any export controls from the US will be eased, and the rare earths will be released in volume," Hassett added.

He also said the Trump administration might be willing to ease some recent curbs on tech exports.

The president told reporters at the White House: "We are doing well with China. China's not easy.

"I'm only getting good reports."

Tokyo led gains in Asian markets, with Hong Kong, Shanghai, Sydney, Seoul, Singapore, Taipei, Wellington and Jakarta also well up.

"The bulls will layer into risk on any rhetoric that publicly keeps the two sides at the table," said Pepperstone's Chris Weston.

"And with the meeting spilling over to a second day, the idea of some sort of loose agreement is enough to underpin the grind higher in US equity and risk exposures more broadly."

Investors are also awaiting key US inflation data this week, which could impact the Federal Reserve's monetary policy amid warnings Trump's tariffs will refuel inflation strengthening the argument to keep interest rates on hold.

However, it also faces pressure from the president to cut rates, with bank officials due to make a decision at their meeting next week.

While recent jobs data has eased concerns about the US economy, analysts remain cautious.

"Tariffs are likely to remain a feature of US trade policy under President Trump," said Matthias Scheiber and John Hockers at Allspring Global Investments.

"A strong US consumer base was helping buoy the global economy and avoid a global recession."

However, they also warned: "The current global trade war coupled with big spending cuts by the US government and possibly higher US inflation could derail US consumer spending to the point that the global economy contracts for multiple quarters."

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 1.0 percent at 38,473.97 (break)

Hong Kong - Hang Seng Index: UP 0.4 percent at 24,275.16

Shanghai - Composite: UP 0.2 percent at 3,405.64

Euro/dollar: DOWN $1.1394 from $1.1420 on Monday

Pound/dollar: DOWN at $1.3530 from $1.3552

Dollar/yen: UP at 145.14 yen 144.60 yen

Euro/pound: DOWN 84.21 from 84.27 pence

West Texas Intermediate: UP 0.5 percent at $65.61 per barrel

Brent North Sea Crude: UP 0.5 percent at $67.37 per barrel

New York - Dow: FLAT at 42,761.76 (close)

London - FTSE 100: DOWN 0.1 percent at 8,832.28 (close)

L.Janezki--BTB