-

Rams ace Nacua apologizes over 'antisemitic' gesture furor

Rams ace Nacua apologizes over 'antisemitic' gesture furor

-

McIlroy wins BBC sports personality award for 2025 heroics

-

Napoli beat Milan in Italian Super Cup semi-final

Napoli beat Milan in Italian Super Cup semi-final

-

Violence erupts in Bangladesh after wounded youth leader dies

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

US hosting new Gaza talks to push next phase of deal

-

Chicago Bears mulling Indiana home over public funding standoff

Chicago Bears mulling Indiana home over public funding standoff

-

Trump renames Kennedy arts center after himself

-

Trump rebrands housing supplement as $1,776 bonuses for US troops

Trump rebrands housing supplement as $1,776 bonuses for US troops

-

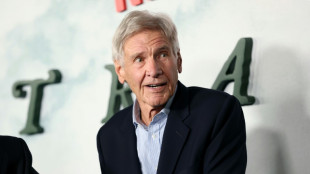

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

-

Trump signs order reclassifying marijuana as less dangerous

Trump signs order reclassifying marijuana as less dangerous

-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

US accuses S.Africa of harassing US officials working with Afrikaners

US accuses S.Africa of harassing US officials working with Afrikaners

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

-

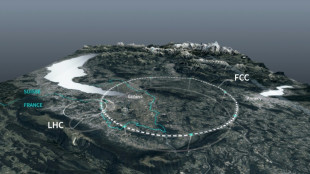

Private donors pledge $1 bn for CERN particle accelerator

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

Not enough evidence against Swedish PM murder suspect: prosecutor

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

Oil prices fall even as Israel-Iran strikes extend into fourth day

Oil prices retreated on Monday as fears of a wider Middle East conflict eased even as Israel and Iran pounded each other with missiles for a fourth day and threatened further attacks.

Gold prices rose back towards a record high thanks to a rush into safe havens but equities were mixed amid hopes that the conflict does not spread.

Investors were also gearing up for key central bank meetings this week, with a particular eye on the US Federal Reserve and Bank of Japan, as well as talks with Washington aimed at avoiding Donald Trump's sky-high tariffs.

Israel's surprise strike against Iranian military and nuclear sites on Friday -- killing top commanders and scientists -- sent crude prices soaring as much as 13 percent at one point on fears about supplies from the region. However, concerns over the conflict spreading appeared to have eased, with prices retreating in Asian trade.

Analysts had warned that the spike could send inflation surging globally again, dealing a blow to long-running efforts by governments and central banks to get it under control and fanning concerns about the impact on already fragile economies.

"The knock-on impact of higher energy prices is that they will slow growth and cause headline inflation to rise," said Tony Sycamore, a market analyst at IG.

"While central banks would prefer to overlook a temporary spike in energy prices, if they remain elevated for a long period, it may feed through into higher core inflation as businesses pass on higher transport and production costs.

"This would hamper central banks' ability to cut interest rates to cushion the anticipated growth slowdown from President Trump's tariffs, which adds another variable for the Fed to consider when it meets to discuss interest rates this week."

Both main oil contracts were down, giving up earlier gains in Asian trade.

- Fed, BoJ in focus -

"Oil markets remain amply supplied with OPEC set on increasing production and demand soft. US production growth has been slowing, but could rebound in the face of sustained higher prices," Morningstar director of equity research Allen Good said.

"Meanwhile, a larger war is unlikely. The Trump administration has already stated it remains committed to talks with Iran.

"Ultimately, fundamentals will dictate price, and they do not suggest much higher prices are necessary. Although the global risk premium could rise, keeping prices moderately higher than where they've been much of the year."

Tokyo closed 1.3 percent higher, boosted by a weaker yen, while Hong Kong reversed early losses and Shanghai, Seoul and Wellington also advanced.

Taipei, Jakarta, Bangkok and Manila retreated while Sydney was flat.

London, Paris and Frankfurt were all higher.

Gold, a go-to asset in times of uncertainty and volatility, rose to around $3,450 an ounce and close to its all-time high of $3,500.

There was little major reaction to data showing China's factory output grew slower than expected last month as trade war pressures bit, while retail sales topped forecasts.

Also in focus is the Group of Seven summit in the Canadian Rockies, which kicked off on Sunday, where the Middle East crisis will be discussed along with trade after Trump's tariff blitz.

Investors are also awaiting bank policy meetings, with the Fed and BoJ the standouts.

Both are expected to stand pat for now but traders will be keeping a close watch on their statements for an idea about the plans for interest rates, with US officials under pressure from Trump to cut.

The Fed meeting "will naturally get the greatest degree of market focus", said Chris Weston at Pepperstone.

"The Fed should remain sufficiently constrained by the many uncertainties to offer anything truly market-moving and the statement should stress that policy is in a sound place for now," he said.

In corporate news, Nippon Steel rose more than three percent after Trump signed an executive order on Friday approving its $14.9 billion merger with US Steel, bringing an end to the long-running saga.

- Key figures at around 0820 GMT -

West Texas Intermediate: DOWN 0.2 percent at $72.82 per barrel

Brent North Sea Crude: DOWN 0.4 percent at $73.95 per barrel

Tokyo - Nikkei 225: UP 1.3 percent at 38,311.33 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 24,060.99 (close)

Shanghai - Composite: UP 0.4 percent at 3,388.73 (close)

London - FTSE 100: UP 0.3 percent at 8,874.0

Euro/dollar: UP at $1.1581 from $1.1540 on Friday

Pound/dollar: UP at $1.3583 from $1.3560

Dollar/yen: UP at 144.26 yen from 144.04 yen

Euro/pound: UP at 85.26 pence from 85.11 pence

New York - Dow: DOWN 1.8 percent at 42,197.79 (close)

S.Keller--BTB