-

Rams ace Nacua apologizes over 'antisemitic' gesture furor

Rams ace Nacua apologizes over 'antisemitic' gesture furor

-

McIlroy wins BBC sports personality award for 2025 heroics

-

Napoli beat Milan in Italian Super Cup semi-final

Napoli beat Milan in Italian Super Cup semi-final

-

Violence erupts in Bangladesh after wounded youth leader dies

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

US hosting new Gaza talks to push next phase of deal

-

Chicago Bears mulling Indiana home over public funding standoff

Chicago Bears mulling Indiana home over public funding standoff

-

Trump renames Kennedy arts center after himself

-

Trump rebrands housing supplement as $1,776 bonuses for US troops

Trump rebrands housing supplement as $1,776 bonuses for US troops

-

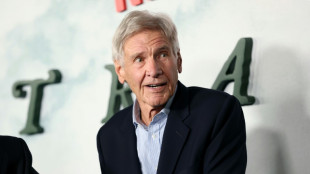

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

-

Trump signs order reclassifying marijuana as less dangerous

Trump signs order reclassifying marijuana as less dangerous

-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

US accuses S.Africa of harassing US officials working with Afrikaners

US accuses S.Africa of harassing US officials working with Afrikaners

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

-

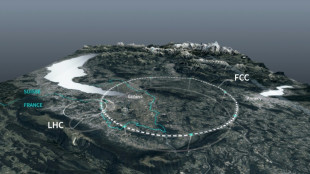

Private donors pledge $1 bn for CERN particle accelerator

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

Not enough evidence against Swedish PM murder suspect: prosecutor

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

US stocks flat as Fed keeps rates steady, oil prices gyrate

Wall Street stocks treaded water Wednesday after the Federal Reserve met expectations and kept interest rates steady while oil prices nudged higher following a volatile session amid ongoing clashes between Iran and Israel.

The Fed held interest rates unchanged for a fourth consecutive meeting, as Chair Jerome Powell said more time was needed to monitor the inflationary effects of President Donald Trump's tariffs.

Powell maintained the Fed is well-positioned to wait to learn more, before considering changes to interest rates.

"Because the economy is still solid," the central bank can take time to see what happens, Powell told reporters at a press conference. "We'll make smarter and better decisions if we just wait a couple of months."

US indices spent part of the day in positive territory before concluding the session essentially flat.

Earlier in Europe, the London stock market rose but Paris and Frankfurt ended the day down. Asian equities closed mixed as well.

The market's ability to avoid major losses amid the Middle East turmoil is "extremely bullish," said Adam Sarhan of 50 Park Investments, while still pointing to trade talk uncertainty as a worry.

The market believes that "most likely cooler heads will prevail on the trade front and on the Middle East front," said Sarhan, who described Wednesday's Fed meeting outcome as in line with expectations.

Israel and Iran exchanged fire again, the sixth day of strikes in their most intense confrontation in history.

Oil prices initially rose Wednesday after Iran's supreme leader Ali Khamenei rejected Trump's demand for an "unconditional surrender," adding to sharp gains made the previous day.

But oil prices fell later in the day after Trump indicated he was still considering whether the United States would join Israeli strikes and indicated that Iran had reached out to seek negotiations.

At the end of the day, prices ticked up again with both major futures crude contracts finishing higher.

Robert Yawger of Mizuho Americas described the market as "hypersensitive" to headlines, having shown "extreme volatility in the last 24 hours."

The Fed is not the only central bank to meet this week.

On Wednesday, Sweden's central bank cut its key interest rate to try and boost the country's economy, as it cited risks linked to trade tensions and the escalating conflict in the Middle East.

The Bank of England is expected to keep its key rate steady Thursday, especially after official data Wednesday showed UK annual inflation fell less than expected in May.

The Bank of Japan on Tuesday kept interest rates unchanged and said it would taper its purchase of government bonds at a slower pace, as trade uncertainty threatens to weigh on the world's number four economy.

- Key figures at around 2030 GMT -

New York - Dow: DOWN 0.1 percent at 42,171.66 (close)

New York - S&P 500: DOWN less than 0.1 percent at 5,980.87 (close)

New York - Nasdaq Composite: UP 0.1 percent at 19,546.27 (close)

London - FTSE 100: UP 0.1 at 8,843.47 (close)

Paris - CAC 40: DOWN 0.4 percent at 7,656.12 (close)

Frankfurt - DAX: DOWN 0.5 percent at 23,317.81 (close)

Tokyo - Nikkei 225: UP 0.9 percent at 38,885.15 (close)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 23,710.69 (close)

Shanghai - Composite: FLAT at 3,388.81 (close)

Euro/dollar: UP at $1.1485 from $1.1480 on Tuesday

Pound/dollar: DOWN at $1.3420 from $1.3429

Dollar/yen: DOWN at 145.09 yen from 145.29 yen

Euro/pound: UP at 85.55 pence from 85.48 pence

Brent North Sea Crude: UP 0.3 percent at $76.70 per barrel

West Texas Intermediate: UP 0.4 percent at $75.14 per barrel

burs-jmb/acb

B.Shevchenko--BTB