-

Rams ace Nacua apologizes over 'antisemitic' gesture furor

Rams ace Nacua apologizes over 'antisemitic' gesture furor

-

McIlroy wins BBC sports personality award for 2025 heroics

-

Napoli beat Milan in Italian Super Cup semi-final

Napoli beat Milan in Italian Super Cup semi-final

-

Violence erupts in Bangladesh after wounded youth leader dies

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

US hosting new Gaza talks to push next phase of deal

-

Chicago Bears mulling Indiana home over public funding standoff

Chicago Bears mulling Indiana home over public funding standoff

-

Trump renames Kennedy arts center after himself

-

Trump rebrands housing supplement as $1,776 bonuses for US troops

Trump rebrands housing supplement as $1,776 bonuses for US troops

-

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

-

Trump signs order reclassifying marijuana as less dangerous

Trump signs order reclassifying marijuana as less dangerous

-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

US accuses S.Africa of harassing US officials working with Afrikaners

US accuses S.Africa of harassing US officials working with Afrikaners

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

-

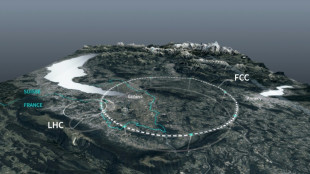

Private donors pledge $1 bn for CERN particle accelerator

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

Not enough evidence against Swedish PM murder suspect: prosecutor

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

Oil prices spike after US strikes on Iran

Oil prices surged and Asian markets traded lower on Monday on concerns of disruption to energy markets after US air strikes on Iran's nuclear facilities.

The dollar strengthened as traders assessed the weekend's events, with Iran threatening US bases in the Middle East as fears grow of an escalating conflict in the volatile region.

Iran is the world's ninth-biggest oil-producing country, with output of about 3.3 million barrels per day.

It exports just under half of that amount and keeps the rest for domestic consumption.

If Tehran decides to retaliate, observers say one of its options would be to seek to close the strategic Strait of Hormuz -- which carries one-fifth of global oil output.

When trading opened on Monday, Brent and the main US crude contract WTI both jumped more than four percent to hit their highest price since January.

They pared these gains however and later in the morning Brent was up 2.1 percent at $75.43 per barrel and WTI was 2.1 percent higher at $78.64.

Economists at MUFG warned of "high uncertainty of the outcomes and duration of this war", publishing a "scenario analysis" of an oil price increase of $10 per barrel.

"An oil price shock would create a real negative impact on most Asian economies" as many are big net energy importers, they wrote, reflecting the market's downbeat mood.

Tokyo's key Nikkei index was down 0.6 percent at the break, with Hong Kong losing 0.4 percent and Shanghai flat. Seoul fell 0.7 percent and Sydney was 0.8 percent lower.

- 'Extreme route' -

The dollar's value rose against other currencies but analysts questioned to what extent this would hold out.

"If the increase proves to be just a knee-jerk reaction to what is perceived as short-lived US involvement in the Middle-East conflict, the dollar's downward path is likely to resume," said Sebastian Boyd, markets live blog strategist at Bloomberg.

US Defense Secretary Pete Hegseth said Sunday that the strikes had "devastated the Iranian nuclear programme", though some officials cautioned that the extent of the damage was unclear.

It comes after Israel launched a bombing campaign against Iran earlier this month.

Chris Weston at Pepperstone said Iran would be able to inflict economic damage on the world without taking the "extreme route" of trying to close the Strait of Hormuz.

"By planting enough belief that they could disrupt this key logistical channel, maritime costs could rise to the point that it would have a significant impact on the supply of crude and gas," he wrote.

At the same time, "while Trump's primary focus will be on the Middle East, headlines on trade negotiations could soon start to roll in and market anxieties could feasibly build".

- Key figures at around 0230 GMT -

Brent North Sea Crude: UP 2.1 percent at $75.43 per barrel

West Texas Intermediate: UP 2.1 percent at $78.64 per barrel

Tokyo - Nikkei 225: DOWN 0.6 percent at 38,175.63 (break)

Hong Kong - Hang Seng Index: DOWN 0.4 percent at 23,426.02

Shanghai - Composite: FLAT at 3,360.97

Euro/dollar: DOWN at $1.1505 from $1.1516 on Friday

Pound/dollar: DOWN at $1.3434 from $1.3444

Dollar/yen: UP at 146.46 yen from 146.13 yen

Euro/pound: DOWN at 85.63 pence from 85.66 pence

New York - Dow: UP 0.1 percent at 42,206.82 (close)

London - FTSE 100: DOWN 0.2 percent at 8,774.65 (close)

J.Fankhauser--BTB