-

TikTok signs joint venture deal to end US ban threat

TikTok signs joint venture deal to end US ban threat

-

Conway's glorious 200 powers New Zealand to 424-3 against West Indies

-

WNBA lockout looms closer after player vote authorizes strike

WNBA lockout looms closer after player vote authorizes strike

-

Honduras begins partial vote recount in Trump-dominated election

-

Nike shares slump as China struggles continue

Nike shares slump as China struggles continue

-

Hundreds swim, float at Bondi Beach to honour shooting victims

-

Crunch time for EU leaders on tapping Russian assets for Ukraine

Crunch time for EU leaders on tapping Russian assets for Ukraine

-

Pope replaces New York's pro-Trump Cardinal with pro-migrant Chicagoan

-

Trump orders marijuana reclassified as less dangerous drug

Trump orders marijuana reclassified as less dangerous drug

-

Rams ace Nacua apologizes over 'antisemitic' gesture furor

-

McIlroy wins BBC sports personality award for 2025 heroics

McIlroy wins BBC sports personality award for 2025 heroics

-

Napoli beat Milan in Italian Super Cup semi-final

-

Violence erupts in Bangladesh after wounded youth leader dies

Violence erupts in Bangladesh after wounded youth leader dies

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

US hosting new Gaza talks to push next phase of deal

US hosting new Gaza talks to push next phase of deal

-

Chicago Bears mulling Indiana home over public funding standoff

-

Trump renames Kennedy arts center after himself

Trump renames Kennedy arts center after himself

-

Trump rebrands housing supplement as $1,776 bonuses for US troops

-

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Trump signs order reclassifying marijuana as less dangerous

-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

US accuses S.Africa of harassing US officials working with Afrikaners

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

Assange files complaint against Nobel Foundation over Machado win

-

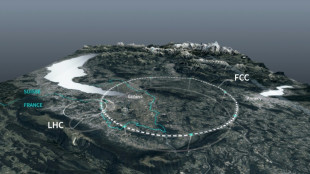

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

Oil slides, stocks jump amid Iran-Israel ceasefire uncertainty

Oil prices sank and stock markets jumped Tuesday, even as uncertainty reined over a Israel-Iran ceasefire.

In volatile trading, crude futures slumped more than five percent after US President Donald Trump's declaration of a ceasefire.

The oil market went on to reduce its losses, however, as Israel and Iran accused each other of breaking the ceasefire -- news confirmed by Trump.

The president berated the two sides, adding that he was "really unhappy" with Israel in particular.

Despite tensions igniting once more, oil prices were still down more than three percent by early afternoon trading in Europe.

"Investors are reacting with relief to apparent news of a US-brokered ceasefire between Iran and Israel," noted AJ Bell investment director Russ Mould.

"Gold slipped back as its safe haven attributes were less in demand," Mould said, adding that the news weighed on share prices of oil producers and miners.

The dollar retreated against main rivals after Trump once more demanded that the US Federal Reserve cut interest rates in a bid to boost the world's biggest economy.

Escalating tensions in the Middle East has removed some focus from Trump's tariffs war, which threatens to dampen global economic growth.

In Germany, where the DAX stocks index rallied 1.9 percent, Chancellor Friedrich Merz urged Iran and Israel to follow the ceasefire announced by Trump.

"We call on both Iran and Israel to heed this call from the American president," Merz told parliament.

"If this ceasefire succeeds... then it will be a very positive development that can make the Middle East and the world safer."

French President Emmanuel Macron said Tuesday that the situation surrounding Iran remained "volatile and unstable".

There are fears that Iran could shut the Strait of Hormuz, a chokepoint for about one-fifth of the world's oil supply.

Rystad Energy analyst Jorge Leon told AFP that he believed the risk of the waterway shutting had diminished despite Iran launching missiles at a US base in Qatar in retaliation for American strikes on Tehran's nuclear facilities.

Trump dismissed the attack as "very weak", and said Iran gave "early notice", adding no one was hurt or killed.

"I think the risk of closing Hormuz now has diminished rapidly because US and Iranian tension is already over," Leon argued.

"I think it's more about what happens just between Israel and Iran."

- Key figures at around 1115 GMT -

West Texas Intermediate: DOWN 3.1 percent at $66.38 per barrel

Brent North Sea Crude: DOWN 3.2 percent at $68.30 per barrel

London - FTSE 100: UP 0.3 percent at 8,786.54 points

Paris - CAC 40: UP 1.2 percent at 7,625.70

Frankfurt - DAX: UP 1.8 percent at 23,686.87

Tokyo - Nikkei 225: UP 1.1 percent at 38,790.56 (close)

Hong Kong - Hang Seng Index: UP 2.1 percent at 24,177.07 (close)

Shanghai - Composite: UP 1.2 percent at 3,420.57 (close)

New York - Dow: UP 0.9 percent at 42,581.78 (close)

Euro/dollar: UP at $1.1596 from $1.1581 on Monday

Pound/dollar: UP at $1.3606 from $1.3526

Dollar/yen: DOWN at 145.06 yen from 146.12 yen

Euro/pound: DOWN at 85.22 pence from 85.60 pence

burs-bcp/ajb/rl

E.Schubert--BTB