-

Trump signs order reclassifying marijuana as less dangerous

Trump signs order reclassifying marijuana as less dangerous

-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

US accuses S.Africa of harassing US officials working with Afrikaners

US accuses S.Africa of harassing US officials working with Afrikaners

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

-

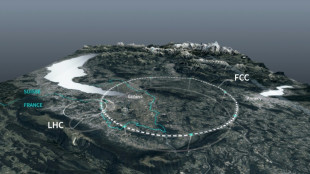

Private donors pledge $1 bn for CERN particle accelerator

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

Not enough evidence against Swedish PM murder suspect: prosecutor

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

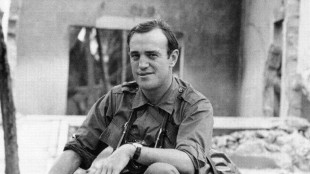

Pulitzer-winning combat reporter Peter Arnett dies at 91

-

EU kicks off crunch summit on Russian asset plan for Ukraine

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Lyon humbled to surpass childhood hero McGrath's wicket tally

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

England vow to keep 'fighting and scrapping' as Ashes slip away

-

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

-

Most Asian markets track Wall St lower as AI fears mount

-

Cambodia says Thailand bombs casino hub on border

Cambodia says Thailand bombs casino hub on border

-

Thai queen wins SEA Games gold in sailing

-

England Ashes dreams on life-support as Australia rip through batting

England Ashes dreams on life-support as Australia rip through batting

-

Masterful Conway, Latham in 323 opening stand as West Indies wilt

| RYCEF | 3.97% | 15.38 | $ | |

| CMSC | 0.09% | 23.28 | $ | |

| RBGPF | -2.23% | 80.22 | $ | |

| NGG | -0.74% | 76.592 | $ | |

| BP | -3.12% | 33.428 | $ | |

| AZN | 1.23% | 90.975 | $ | |

| RELX | 0.42% | 40.73 | $ | |

| RIO | 0.68% | 77.72 | $ | |

| BTI | 0.08% | 57.215 | $ | |

| GSK | -0.54% | 48.45 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| VOD | 0.16% | 12.83 | $ | |

| CMSD | 0.09% | 23.3 | $ | |

| JRI | -0.09% | 13.418 | $ | |

| BCC | 1.62% | 77.55 | $ | |

| BCE | -1.11% | 22.895 | $ |

US Fed chair to signal no rush for rate cuts despite Trump pressure

US Federal Reserve Chair Jerome Powell will tell Congress Tuesday that the central bank can afford to wait for the impact of tariffs before deciding on further interest rate cuts -- despite President Donald Trump's calls to do so.

The Fed has a duty to prevent a one-time spike in prices from becoming an "ongoing inflation problem," Powell said in prepared remarks to the House Committee on Financial Services.

"For the time being, we are well positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance," he added.

Powell's reiteration that the Fed can wait to lower rates comes after two Fed officials recently expressed openness to cuts as early as in July.

The Fed has held the benchmark lending rate steady this year after its last reduction in December, bringing the level to a range between 4.25 percent and 4.50 percent.

After unveiling the Fed's latest announcement to keep rates unchanged for a fourth straight policy meeting last week, Powell told reporters that the bank would make smarter decisions if it waited to understand how Trump's tariffs impact the economy.

But hours before Powell's testimony Tuesday, Trump again urged the Fed chair to slash rates, saying these should be "at least two to three points lower" given that inflation remains benign.

"I hope Congress really works this very dumb, hardheaded person, over," Trump wrote on his Truth Social platform.

Powell is expected to maintain Tuesday that it remains unclear how concerns over US trade policies could affect future spending and investment.

"Increases in tariffs this year are likely to push up prices and weigh on economic activity," he said in the prepared remarks.

For now, Powell added: "Despite elevated uncertainty, the economy is in a solid position."

Since returning to the presidency, Trump has imposed a 10 percent tariff on almost all trading partners and steeper rates on imports of steel, aluminum and autos.

Economists warn the levies could fuel inflation and bog down economic growth, although widespread effects have so far been muted.

This is partly because Trump has backed off or postponed his most punishing salvos. Businesses also stocked up on inventory in anticipation of the duties, avoiding immediate consumer price hikes.

But Powell expects to learn more about the tariffs' effects over the summer, given that these take time to filter through.

Although the Fed has penciled in two rate cuts this year, there is growing divergence among policymakers about whether the central bank can lower rates at all this year.

While inflation has eased significantly from highs in mid-2022, Powell said in remarks Tuesday that it remains "somewhat elevated" relative to the bank's longer-run two percent goal.

F.Müller--BTB