-

Rams ace Nacua apologizes over 'antisemitic' gesture furor

Rams ace Nacua apologizes over 'antisemitic' gesture furor

-

McIlroy wins BBC sports personality award for 2025 heroics

-

Napoli beat Milan in Italian Super Cup semi-final

Napoli beat Milan in Italian Super Cup semi-final

-

Violence erupts in Bangladesh after wounded youth leader dies

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

US hosting new Gaza talks to push next phase of deal

-

Chicago Bears mulling Indiana home over public funding standoff

Chicago Bears mulling Indiana home over public funding standoff

-

Trump renames Kennedy arts center after himself

-

Trump rebrands housing supplement as $1,776 bonuses for US troops

Trump rebrands housing supplement as $1,776 bonuses for US troops

-

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

-

Trump signs order reclassifying marijuana as less dangerous

Trump signs order reclassifying marijuana as less dangerous

-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

US accuses S.Africa of harassing US officials working with Afrikaners

US accuses S.Africa of harassing US officials working with Afrikaners

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

-

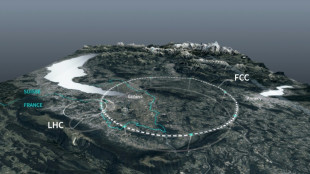

Private donors pledge $1 bn for CERN particle accelerator

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

Not enough evidence against Swedish PM murder suspect: prosecutor

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

Stocks rise as US-China reach trade deal framework

European stocks rose Friday as the United States and China moved closer to a trade deal and as hopes of a further delay to reciprocal tariffs were boosted.

With the Israel-Iran ceasefire holding, investors turned attention back to the wider economy and the US president's trade war.

"The key theme for markets in the next week and a half will be US trade agreements," ahead of the July 9 deadline ending reciprocal tariff reprieves, said Kathleen Brooks, research director at trading group XTB.

President Donald Trump on Thursday said the United States had signed a deal relating to trade with China, without providing further details.

China said Friday that Washington would lift "restrictive measures", while Beijing would "review and approve" items under export controls.

Adding to positive market sentiment, US Treasury Secretary Scott Bessent said a "revenge tax" on foreign-owned companies would be dropped from Trump's tax bill as he signalled a forthcoming agreement with G7 nations to exempt US firms from certain taxes.

European stock markets rose Friday, with the Paris CAC 40 leading the way around midday, boosted by a rise in luxury stocks.

Traders brushed off data showing that inflation edged up in France and Spain in June, even as it added to speculation that the European Central Bank may pause its interest rate-cut cycle.

Investor also awaited the release of the US Federal Reserve's preferred inflation measure for May due Friday.

In Asia, Tokyo rallied more than one percent to break 40,000 points for the first time since January, while Hong Kong and Shanghai equities closed lower.

Separately on Thursday, the White House indicated that Washington could extend a July deadline when steeper tariffs affecting dozens of economies are due to kick in.

The president imposed a 10-percent tariff on goods from nearly every country at start of April, but he put off higher rates on dozens of nations to allow for talks.

- Weaker dollar -

The dollar held around three-year lows Friday as traders ramp up bets on US interest rate cuts, especially after Trump hinted at replacing Fed chief Jerome Powell.

The prospect of lower borrowing costs sent the Dollar Index, which compares the greenback to a basket of major currencies, to its lowest level since March 2022.

Weak economic data on Thursday -- showing that the world's top economy contracted more than previous estimate in the first quarter and softer cosumer spending -- further fuelled rate cut expectations.

All three main equity indices on Wall Street rallied Thursday, with the Nasdaq hitting a record high and the S&P 500 within a whisker of a new closing peak.

In company news, shares in Chinese smartphone maker Xiaomi jumped more than three percent to a record high in Hong Kong as it enjoyed strong early orders for its YU7 sport utility vehicle, its second foray into the competitive electric vehicle market.

- Key figures at around 1040 GMT -

London - FTSE 100: UP 0.5 percent at 8,781.49 points

Paris - CAC 40: UP 1.3 percent at 7,654.06

Frankfurt - DAX: UP 0.7 percent at 23,806.46

Tokyo - Nikkei 225: UP 1.4 percent at 40,150.79 (close)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 24,284.15 (close)

Shanghai - Composite: DOWN 0.7 percent at 3,424.23 (close)

New York - Dow: UP 0.9 percent at 43,386.84 (close)

Euro/dollar: UP at $1.1704 from $1.1701 on Thursday

Pound/dollar: DOWN at $1.3724 from $1.3725

Dollar/yen: UP at 144.59 yen from 144.44 yen

Euro/pound: UP at 85.29 pence from 85.22 pence

West Texas Intermediate: UP 0.7 percent at $65.70 per barrel

Brent North Sea Crude: UP 0.6 percent at $67.07 per barrel

K.Brown--BTB