-

Napoli beat Milan in Italian Super Cup semi-final

Napoli beat Milan in Italian Super Cup semi-final

-

Violence erupts in Bangladesh after wounded youth leader dies

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

US hosting new Gaza talks to push next phase of deal

-

Chicago Bears mulling Indiana home over public funding standoff

Chicago Bears mulling Indiana home over public funding standoff

-

Trump renames Kennedy arts center after himself

-

Trump rebrands housing supplement as $1,776 bonuses for US troops

Trump rebrands housing supplement as $1,776 bonuses for US troops

-

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

-

Trump signs order reclassifying marijuana as less dangerous

Trump signs order reclassifying marijuana as less dangerous

-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

US accuses S.Africa of harassing US officials working with Afrikaners

US accuses S.Africa of harassing US officials working with Afrikaners

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

-

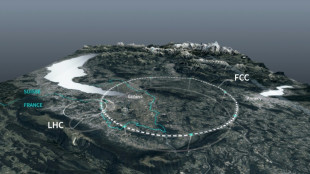

Private donors pledge $1 bn for CERN particle accelerator

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

Not enough evidence against Swedish PM murder suspect: prosecutor

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

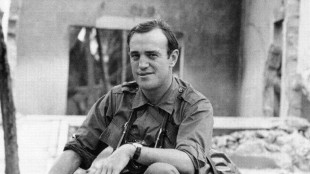

Pulitzer-winning combat reporter Peter Arnett dies at 91

Tougher Singapore crypto regulations kick in

Singapore ramped up crypto exchange regulations Monday in a bid to curb money laundering and boost market confidence after a series of high-profile scandals rattled the sector.

The city-state's central bank last month said digital token service providers (DTSPs) that served only overseas clients must have a licence to continue operations past June 30 -- or close up shop.

The Monetary Authority of Singapore in a subsequent statement added that it has "set the bar high for licensing and will generally not issue a licence" for such operations.

Singapore, a major Asian financial hub, has taken a hit to its reputation after several high-profile recent cases dented trust in the emerging crypto sector.

These included the collapse of cryptocurrency hedge fund Three Arrows Capital and Terraform Labs, which both filed for bankruptcy in 2022.

"The money laundering risks are higher in such business models and if their substantive regulated activity is outside of Singapore, the MAS is unable to effectively supervise such persons," the central bank said, referring to firms serving solely foreign clients.

Analysts welcomed the move to tighten controls on crypto exchanges.

"With the new DTSP regime, MAS is reinforcing that financial integrity is a red line," Chengyi Ong, head of Asia Pacific policy at crypto data group Chainalysis, told AFP.

"The goal is to insulate Singapore from the reputational risk that a crypto business based in Singapore, operating without sufficient oversight, is knowingly or unknowingly involved in illicit activity."

Law firm Gibson, Dunn & Crutcher said in a comment on its website that the move will "allow Singapore to be fully compliant" with the requirements of the Financial Action Task Force, the France-based global money laundering and terrorist financing watchdog.

Three Arrows Capital filed for bankruptcy in 2022 when its fortunes suffered a sharp decline after a massive sell-off of assets it had bet on as prices nosedived in crypto markets.

Its Singaporean co-founder Su Zhu was arrested at Changi Airport while trying to leave the country and jailed for four months.

A court in the British Virgin Islands later ordered a US$1.14 billion worldwide asset freeze on the company's founders.

Singapore-based Terraform Labs also saw its cryptocurrencies crash dramatically in 2022, forcing it to file for bankruptcy protection in the United States.

The collapse of the firm's TerraUSD and Luna wiped out around US$40 billion in investments and caused wider losses in the global crypto market estimated at more than US$400 billion.

South Korean Do Kwon, who co-founded Terraform in 2018, was arrested in 2023 in Montenegro and later extradited to the United States on fraud charges related to the crash.

He had been on the run after fleeing Singapore and South Korea.

H.Seidel--BTB