-

WNBA lockout looms closer after player vote authorizes strike

WNBA lockout looms closer after player vote authorizes strike

-

Honduras begins partial vote recount in Trump-dominated election

-

Nike shares slump as China struggles continue

Nike shares slump as China struggles continue

-

Hundreds swim, float at Bondi Beach to honour shooting victims

-

Crunch time for EU leaders on tapping Russian assets for Ukraine

Crunch time for EU leaders on tapping Russian assets for Ukraine

-

Pope replaces New York's pro-Trump Cardinal with pro-migrant Chicagoan

-

Trump orders marijuana reclassified as less dangerous drug

Trump orders marijuana reclassified as less dangerous drug

-

Rams ace Nacua apologizes over 'antisemitic' gesture furor

-

McIlroy wins BBC sports personality award for 2025 heroics

McIlroy wins BBC sports personality award for 2025 heroics

-

Napoli beat Milan in Italian Super Cup semi-final

-

Violence erupts in Bangladesh after wounded youth leader dies

Violence erupts in Bangladesh after wounded youth leader dies

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

US hosting new Gaza talks to push next phase of deal

US hosting new Gaza talks to push next phase of deal

-

Chicago Bears mulling Indiana home over public funding standoff

-

Trump renames Kennedy arts center after himself

Trump renames Kennedy arts center after himself

-

Trump rebrands housing supplement as $1,776 bonuses for US troops

-

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Trump signs order reclassifying marijuana as less dangerous

-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

US accuses S.Africa of harassing US officials working with Afrikaners

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

Assange files complaint against Nobel Foundation over Machado win

-

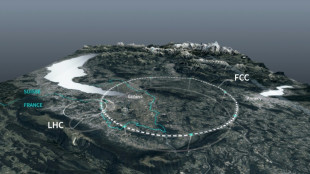

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

Stocks muted as investors eye US trade talks

Global equities steadied Monday as investors kept tabs on countries' efforts to strike trade deals with the United States before a key deadline next week.

Canada said Sunday it will restart trade negotiations with the United States after it rescinded a tax impacting US tech firms that had prompted US President Donald Trump to call off talks.

That boosted optimism for other governments to make deals with Trump to avoid his steep levies, as the July 9 cut-off for tariff reprieve looms.

"Investors seem confident trade deals will be struck, geopolitical tensions ease, and a major economic slump is avoided," said Dan Coatsworth, investment analyst at AJ Bell.

"The big unknown is whether investors are correct or are simply being too complacent," he added.

Officials from Japan and India have extended their stays in Washington to continue talks, raising hopes for agreements with two of the world's biggest economies.

Trade optimism helped boost most Asian stocks and US futures.

Meanwhile European equities were mixed in more tentative trade, with Paris ticking higher, London flat and Frankfurt edging lower.

Over the last month, US indices have notably outperformed European ones, explained Kathleen Brooks, research director at trading group XTB.

She attributed this to a "slowdown in the defence sector."

The dollar extended losses against its peers on Monday as traders ramped up bets for at least two rate cuts this year following Trump's indication he could choose a successor to Federal Reserve boss Jerome Powell within months.

A key US jobs report on Thursday will also be pored over for signs of the pace of interest-rate cuts.

Eyes were also on Trump's signature tax-cutting bill -- now inching towards a Senate vote -- that would add trillions of dollars to the national debt.

The "One Big Beautiful Bill" extends Trump's expiring first-term tax cuts at a cost of $4.5 trillion and beefs up border security.

The Republican president has ramped up pressure to get the package to his desk by July 4, and called out wavering lawmakers from his party.

However, there are worries about the impact on the economy, with the nonpartisan Congressional Budget Office estimating the measure would add nearly $3.3 trillion to US deficits over a decade.

The S&P 500 and Nasdaq finished at all-time peaks Friday amid optimism governments will be able to avoid swingeing US tariffs.

There was little major reaction on Monday to data showing the contraction in Chinese factory activity eased further in June after a China-US trade truce.

- Key figures at around 1050 GMT -

London - FTSE 100: FLAT at 8,799.59 points

Paris - CAC 40: UP 0.1 percent at 7,698.59

Frankfurt - DAX: DOWN 0.1 percent at 23,998.68

Tokyo - Nikkei 225: UP 0.8 percent at 40,487.39 (close)

Hong Kong - Hang Seng Index: DOWN 0.9 percent at 24,072.28 (close)

Shanghai - Composite: UP 0.6 percent at 3,444.43 (close)

New York - Dow: UP 1.0 percent at 43,819.27 (close)

Euro/dollar: UP at $1.1723 from $1.1718 on Friday

Pound/dollar: DOWN at $1.3698 from $1.3715

Dollar/yen: DOWN at 144.20 yen from 144.68 yen

Euro/pound: UP at 85.59 pence from 85.43 pence

West Texas Intermediate: DOWN 0.4 percent at $65.25 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $66.61 per barrel

W.Lapointe--BTB