-

TikTok signs joint venture deal to end US ban threat

TikTok signs joint venture deal to end US ban threat

-

Conway's glorious 200 powers New Zealand to 424-3 against West Indies

-

WNBA lockout looms closer after player vote authorizes strike

WNBA lockout looms closer after player vote authorizes strike

-

Honduras begins partial vote recount in Trump-dominated election

-

Nike shares slump as China struggles continue

Nike shares slump as China struggles continue

-

Hundreds swim, float at Bondi Beach to honour shooting victims

-

Crunch time for EU leaders on tapping Russian assets for Ukraine

Crunch time for EU leaders on tapping Russian assets for Ukraine

-

Pope replaces New York's pro-Trump Cardinal with pro-migrant Chicagoan

-

Trump orders marijuana reclassified as less dangerous drug

Trump orders marijuana reclassified as less dangerous drug

-

Rams ace Nacua apologizes over 'antisemitic' gesture furor

-

McIlroy wins BBC sports personality award for 2025 heroics

McIlroy wins BBC sports personality award for 2025 heroics

-

Napoli beat Milan in Italian Super Cup semi-final

-

Violence erupts in Bangladesh after wounded youth leader dies

Violence erupts in Bangladesh after wounded youth leader dies

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

US hosting new Gaza talks to push next phase of deal

US hosting new Gaza talks to push next phase of deal

-

Chicago Bears mulling Indiana home over public funding standoff

-

Trump renames Kennedy arts center after himself

Trump renames Kennedy arts center after himself

-

Trump rebrands housing supplement as $1,776 bonuses for US troops

-

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Trump signs order reclassifying marijuana as less dangerous

-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

US accuses S.Africa of harassing US officials working with Afrikaners

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

Assange files complaint against Nobel Foundation over Machado win

-

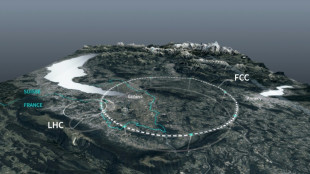

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

Stocks retreat as profit-taking follows Wall Street records

US and European stocks were mostly lower on Tuesday after Wall Street indexes closed the second quarter at record highs, with investors locking in gains while weighing up the prospects for US trade deals ahead of President Donald Trump's July 9 tariff deadline.

Asian markets ended mixed after both the S&P 500 and the Nasdaq hit records, with Shanghai rising but Tokyo sinking more than one percent after Trump threatened more tariffs on Japan in a row over rice and autos.

"The next few days are going to be testing times for governments in many parts of the world as they try to hammer out trade deals with the US," said Dan Coatsworth, an investment analyst at AJ Bell.

While few trade agreements have been reached so far, the week began with some optimism as Canada and the United States agreed to restart trade talks after Ottawa scrapped a digital services tax contested by US tech giants.

Comments from Trump and some of his top officials also suggested the deadline was flexible, and that several pacts were nearly completed.

"We expect risk sentiment to remain shaky until a deal is agreed... investors are on pause for now and are waiting for concrete news before making their next move," said Kathleen Brooks, research director at trading group XTB.

The dollar remained under pressure after its worst start to the year since 1973, with confidence deteriorating amongst many foreign investors since Trump returned to the White House.

The Dollar Index, which compares the greenback to a basket of major currencies, fell 10.8 percent in the first half of the year, its steepest decline since the dollar became the global benchmark currency.

Investors increasingly expect the Federal Reserve to cut rates at least twice this year -- with Trump having loudly criticised Fed chief Jerome Powell for not doing so sooner -- and all eyes will be on US jobs data due this week.

Investors are also keeping an eye on Trump's multitrillion-dollar tax-cutting bill, which is being debated in the Senate.

Trump has urged lawmakers to pass the bill by July 4 -- when Wall Street will be closed for Independence Day -- but its passage remains uncertain over concerns that it will add $3 trillion to US deficits.

For David Morrison at Trade Nation, the dollar's weakness reflects "ongoing concerns over trade, tariffs, national debt and central bank independence".

The Tokyo market drop came after Trump threatened to impose a fresh levy on Japan over a row about the country not buying US rice.

Japan has seen rice prices double over the past year owing to supply issues caused by various factors, piling pressure on Prime Minister Shigeru Ishiba ahead of elections this month.

Trump also hit out at what he considered an unfair balance in the trade in cars between the two countries, and floated the idea of keeping a 25-percent tariff on autos in place.

- Key figures at around 1340 GMT -

New York - Dow: FLAT at 44,109.67

New York - S&P 500: DOWN 0.2 percent at 6,190.18

New York - Nasdaq: DOWN 0.4 percent at 20,280.15

London - FTSE 100: FLAT at 8,759.34 points

Paris - CAC 40: DOWN 0.5 percent at 7,625.88

Frankfurt - DAX: DOWN 0.8 percent at 23,722.89

Tokyo - Nikkei 225: DOWN 1.2 percent at 39,986.33 (close)

Shanghai - Composite: UP 0.4 percent at 3,457.75 (close)

Hong Kong - Hang Seng Index: Closed for holiday

Euro/dollar: UP at $1.1800 from $1.1785 on Monday

Pound/dollar: DOWN at $1.3730 from $1.3732

Dollar/yen: DOWN at 143.24 yen from 143.98 yen

Euro/pound: UP at 85.94 pence from 85.82 pence

Brent North Sea Crude: UP 0.5 percent at $67.04 per barrel

West Texas Intermediate: UP 0.6 percent at $65.47 per barrel

F.Pavlenko--BTB