-

Napoli beat Milan in Italian Super Cup semi-final

Napoli beat Milan in Italian Super Cup semi-final

-

Violence erupts in Bangladesh after wounded youth leader dies

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

US hosting new Gaza talks to push next phase of deal

-

Chicago Bears mulling Indiana home over public funding standoff

Chicago Bears mulling Indiana home over public funding standoff

-

Trump renames Kennedy arts center after himself

-

Trump rebrands housing supplement as $1,776 bonuses for US troops

Trump rebrands housing supplement as $1,776 bonuses for US troops

-

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

-

Trump signs order reclassifying marijuana as less dangerous

Trump signs order reclassifying marijuana as less dangerous

-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

US accuses S.Africa of harassing US officials working with Afrikaners

US accuses S.Africa of harassing US officials working with Afrikaners

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

-

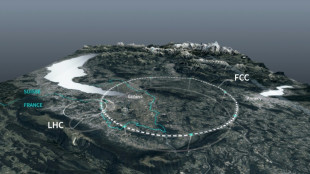

Private donors pledge $1 bn for CERN particle accelerator

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

Not enough evidence against Swedish PM murder suspect: prosecutor

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

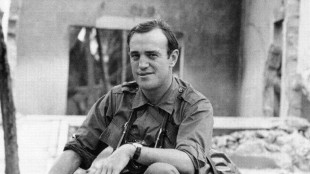

Pulitzer-winning combat reporter Peter Arnett dies at 91

US stocks mostly rise on better inflation data while dollar retreats

Wall Street stocks mostly rose Tuesday while oil prices advanced, extending a rally as the improved state of US-China trade boosts the economic outlook.

Both the S&P 500 and Nasdaq finished solidly higher following benign US inflation data while the Dow retreated after weakness in UnitedHealth Group shares.

Markets continued to cheer the US-China announcement Monday of a de-escalation of trade tensions. The two countries agreed to significantly lower levies for 90 days while they work to hash out an agreement.

The tech-rich Nasdaq led major US indices, winning 1.6 percent.

Oil prices also climbed more than two percent as traders pencil in more oil demand.

"It seems as if the euphoria that was ignited yesterday or over the weekend has continued into today at least for the S&P 500 and the Nasdaq," said Sam Stovall of CFRA Research.

The consumer price index eased to 2.3 percent in April from a year ago, a tick below the 2.4 percent figure recorded in March.

Some analysts cautioned that it was still too early to see the implications of US President Donald Trump's tariff policies, some of which have been rolled back or suspended.

But the weaker inflation data put pressure on the dollar, with more traders betting the Federal Reserve will soon cut interest rates.

In Europe, London closed barely changed, while Paris and Frankfurt both ticked up 0.3 percent.

Asian equities had finished with strong gains, in their catch-up session digesting Wall Street's jump on Monday, although Hong Kong dropped nearly two percent on profit-taking.

On the corporate front, the big focus was on the auto sector after major news out of Japan.

Nissan posted an annual net loss of $4.5 billion, confirmed plans to slash 15 percent of its global workforce and warned about the possible impact of US tariffs.

The carmaker, whose mooted merger with Honda collapsed this year, is heavily indebted and engaged in an expensive business restructuring plan.

For its part, Honda on Tuesday forecast a 70-percent drop in net profit for the 2025-26 financial year.

"The impact of tariff policies in various countries on our business has been very significant, and frequent revisions are being made, making it difficult to formulate an outlook," said Honda chief executive Toshihiro Mibe.

- Key figures at around 2050 GMT -

New York - Dow: DOWN 0.6 percent at 42,140.43 (close)

New York - S&P 500: UP 0.7 percent at 5,886.55 (close)

New York - Nasdaq Composite: UP 1.6 percent at 19,010.08 (close)

London - FTSE 100: FLAT at 8,602.92 (close)

Paris - CAC 40: UP 0.3 percent at 7,873.83 (close)

Frankfurt - DAX: UP 0.3 percent at 23,638.56 (close)

Tokyo - Nikkei 225: UP 1.4 percent at 38,183.26 (close)

Hong Kong - Hang Seng Index: DOWN 1.9 percent at 23,108.27 (close)

Shanghai - Composite: UP 0.2 percent at 3,374.87 (close)

Euro/dollar: UP at $1.1189 from $1.1087 on Monday

Pound/dollar: UP at $1.3304 from $1.3176

Dollar/yen: DOWN at 147.47 yen from 148.46 yen

Euro/pound: DOWN at 84.07 pence from 84.14 pence

Brent North Sea Crude: UP 2.6 percent at $66.63 per barrel

West Texas Intermediate: UP 2.8 percent at $63.67 per barrel

burs-jmb/jgc

W.Lapointe--BTB