-

Brazil's top court strikes down law blocking Indigenous land claims

Brazil's top court strikes down law blocking Indigenous land claims

-

Conway falls for 227 as New Zealand pass 500 in West Indies Test

-

'We are ghosts': Britain's migrant night workers

'We are ghosts': Britain's migrant night workers

-

Asian markets rise as US inflation eases, Micron soothes tech fears

-

Giant lanterns light up Christmas in Catholic Philippines

Giant lanterns light up Christmas in Catholic Philippines

-

TikTok: key things to know

-

Putin, emboldened by Ukraine gains, to hold annual presser

Putin, emboldened by Ukraine gains, to hold annual presser

-

Deportation fears spur US migrants to entrust guardianship of their children

-

Upstart gangsters shake Japan's yakuza

Upstart gangsters shake Japan's yakuza

-

Trump signs $900 bn defense policy bill into law

-

Stokes's 83 gives England hope as Australia lead by 102 in 3rd Test

Stokes's 83 gives England hope as Australia lead by 102 in 3rd Test

-

Go long: the rise and rise of the NFL field goal

-

Australia announces gun buyback, day of 'reflection' after Bondi shooting

Australia announces gun buyback, day of 'reflection' after Bondi shooting

-

New Zealand Cricket chief quits after split over new T20 league

-

England all out for 286, trail Australia by 85 in 3rd Test

England all out for 286, trail Australia by 85 in 3rd Test

-

Australian announces gun buyback, day of 'reflection' after Bondi shooting

-

Joshua takes huge weight advantage into Paul fight

Joshua takes huge weight advantage into Paul fight

-

TikTok signs joint venture deal to end US ban threat

-

Conway's glorious 200 powers New Zealand to 424-3 against West Indies

Conway's glorious 200 powers New Zealand to 424-3 against West Indies

-

WNBA lockout looms closer after player vote authorizes strike

-

Honduras begins partial vote recount in Trump-dominated election

Honduras begins partial vote recount in Trump-dominated election

-

Nike shares slump as China struggles continue

-

Hundreds swim, float at Bondi Beach to honour shooting victims

Hundreds swim, float at Bondi Beach to honour shooting victims

-

Crunch time for EU leaders on tapping Russian assets for Ukraine

-

Pope replaces New York's pro-Trump Cardinal with pro-migrant Chicagoan

Pope replaces New York's pro-Trump Cardinal with pro-migrant Chicagoan

-

Trump orders marijuana reclassified as less dangerous drug

-

Rams ace Nacua apologizes over 'antisemitic' gesture furor

Rams ace Nacua apologizes over 'antisemitic' gesture furor

-

McIlroy wins BBC sports personality award for 2025 heroics

-

Napoli beat Milan in Italian Super Cup semi-final

Napoli beat Milan in Italian Super Cup semi-final

-

Violence erupts in Bangladesh after wounded youth leader dies

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

US hosting new Gaza talks to push next phase of deal

-

Chicago Bears mulling Indiana home over public funding standoff

Chicago Bears mulling Indiana home over public funding standoff

-

Trump renames Kennedy arts center after himself

-

Trump rebrands housing supplement as $1,776 bonuses for US troops

Trump rebrands housing supplement as $1,776 bonuses for US troops

-

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

-

Trump signs order reclassifying marijuana as less dangerous

Trump signs order reclassifying marijuana as less dangerous

-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

US accuses S.Africa of harassing US officials working with Afrikaners

US accuses S.Africa of harassing US officials working with Afrikaners

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

-

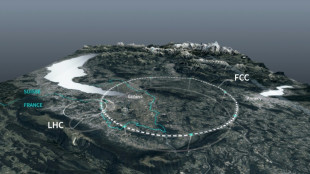

Private donors pledge $1 bn for CERN particle accelerator

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

Asian markets rebound to track Wall St up as China cuts rates

Asian markets rose Tuesday as investor sentiment returned following the previous day's US rating-fuelled losses, with sentiment also boosted after China cut interest rates to historic lows.

The rally tracked advances on Wall Street, where the initial selloff sparked by Moody's removal of Washington's triple-A grade soon gave way to a push back into beaten-down equities amid hopes about US trade talks.

After Donald Trump's April 2 tariff blitz sowed global turmoil, the deal between China and the United States last week -- which slashed eye-watering tit-for-tat levies -- has re-energised dealers and pushed most markets back to levels before the US president's "Liberation Day" duties.

Trump suspended his harshest measures for 90 days until mid-July, and while few solid agreements have been reached so far there is optimism that the worst of the crisis has passed.

Traders are also hoping the Federal Reserve will cut interest rates this year, with two reductions expected, according to Bloomberg News.

However, two central bank officials remained cautious about when to resume their monetary easing, amid worries that the tariffs and possible tax cuts will reignite inflation.

New York Fed boss John Williams indicated decision-makers might not be able to move before September, while the central bank's vice chairman Philip Jefferson urged patience, adding that it was crucial to make sure any price increases do not become entrenched.

In early trade, Hong Kong, Shanghai, Tokyo, Sydney, Seoul, Singapore, Taipei, Wellington and Jakarta were all up.

The gains came as China's central bank cut two key interest rates as officials battle to kickstart the economy, which faces persistent headwinds from a long-term domestic spending slump, a protracted debt crisis in the property sector and high youth unemployment.

The People's Bank of China lowered its one-year Loan Prime Rate (LPR), the benchmark for the most advantageous rates lenders can offer to businesses and households, to 3.0 percent from 3.1 percent.

The five-year LPR, the benchmark for mortgage loans, was cut to 3.5 percent to 3.6 percent.

Both rates were last cut in October to what were then record lows.

"The rate cuts will reduce interest payments on existing loans, taking some pressure off indebted firms. It will also reduce the price of new loans," Zichun Huang, China economist at Capital Economics, said in a note.

However, she added that "modest rate cuts alone are unlikely to meaningfully boost loan demand or wider economic activity".

The "reductions... probably won't be the last this year", she said.

The move came a day after data showed Chinese retail sales came in below expectations in April, highlighting a continued lack of confidence among consumers.

In Hong Kong, Chinese battery giant CATL soared more than 13 percent on its debut, having raised US$4.6 billion in the world's biggest initial public offering this year.

The firm, which produces more than a third of all electric vehicle batteries sold worldwide, saw strong demand even after it was designated as a "Chinese military company" on a US list in January.

The US House Select Committee on the Chinese Communist Party even highlighted this inclusion in letters to two US banks in April, urging them to withdraw from the IPO deal with the "Chinese military-linked company".

But the two banks -- JPMorgan and Bank of America -- are still onboard.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 0.5 percent at 37,691.56 (break)

Hong Kong - Hang Seng Index: UP 1.0 percent at 23,568.99

Shanghai - Composite: UP 0.2 percent at 3,373.52

Euro/dollar: DOWN at $1.1243 from $1.1244 on Monday

Pound/dollar: UP at $1.3363 from $1.3360

Dollar/yen: DOWN at 144.84 yen from 144.87 yen

Euro/pound: UP at 84.15 pence from 84.14 pence

West Texas Intermediate: UP 0.2 percent at $62.82 per barrel

Brent North Sea Crude: DOWN 0.1 percent at $65.46 per barrel

New York - Dow: UP 0.3 percent at 42,792.07 (close)

London - FTSE 100: UP 0.2 percent at 8,699.31 (close)

W.Lapointe--BTB