-

TikTok signs joint venture deal to end US ban threat

TikTok signs joint venture deal to end US ban threat

-

Conway's glorious 200 powers New Zealand to 424-3 against West Indies

-

WNBA lockout looms closer after player vote authorizes strike

WNBA lockout looms closer after player vote authorizes strike

-

Honduras begins partial vote recount in Trump-dominated election

-

Nike shares slump as China struggles continue

Nike shares slump as China struggles continue

-

Hundreds swim, float at Bondi Beach to honour shooting victims

-

Crunch time for EU leaders on tapping Russian assets for Ukraine

Crunch time for EU leaders on tapping Russian assets for Ukraine

-

Pope replaces New York's pro-Trump Cardinal with pro-migrant Chicagoan

-

Trump orders marijuana reclassified as less dangerous drug

Trump orders marijuana reclassified as less dangerous drug

-

Rams ace Nacua apologizes over 'antisemitic' gesture furor

-

McIlroy wins BBC sports personality award for 2025 heroics

McIlroy wins BBC sports personality award for 2025 heroics

-

Napoli beat Milan in Italian Super Cup semi-final

-

Violence erupts in Bangladesh after wounded youth leader dies

Violence erupts in Bangladesh after wounded youth leader dies

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

US hosting new Gaza talks to push next phase of deal

US hosting new Gaza talks to push next phase of deal

-

Chicago Bears mulling Indiana home over public funding standoff

-

Trump renames Kennedy arts center after himself

Trump renames Kennedy arts center after himself

-

Trump rebrands housing supplement as $1,776 bonuses for US troops

-

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Trump signs order reclassifying marijuana as less dangerous

-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

US accuses S.Africa of harassing US officials working with Afrikaners

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

Assange files complaint against Nobel Foundation over Machado win

-

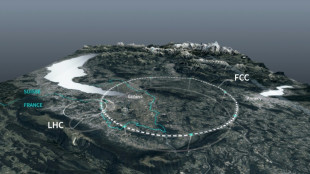

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

Global stocks mixed, oil lower as market digests latest on Iran

Global equities were mixed Friday, while oil prices retreated as markets weighed the latest developments in the war between Iran and Israel.

Markets rose after US President Donald Trump said he would allow for up to two weeks before possible US military action against Iran.

But on Friday afternoon, Trump expressed doubt that European powers would be able to help end the Iran-Israel war, telling reporters "Europe is not going to be able to help in this."

Both the S&P 500 and Nasdaq finished lower following a choppy session. Analysts pointed to broad investor unease.

"We have a situation in the Middle East where missiles are still firing, there's no ceasefire and there's a fear that the US may be involved," said Adam Sarhan of 50 Park Investments.

In light of uncertainty on Iran, trade and other areas, "investors are de-risking, they're selling stocks ahead of the weekend," Sarhan said.

European equity markets mostly rose while Asian markets were mixed.

The Brent international crude benchmark contract dropped more than two percent after Trump's remarks, with analysts pointing to investor relief following fears that the United States could immediately join the Israeli campaign.

US oil prices fell more modestly because a US holiday on Thursday kept trading volumes low that day.

"News that President Trump would delay any decision on joining Israel's attacks against Iran has boosted the market mood," said Kathleen Brooks, an analyst at trading firm XTB.

"Brent crude has dropped... as traders price out the worst-case scenario for geopolitics."

Crude futures had soared and global equities slumped in recent sessions as the Israel-Iran conflict showed no signs of easing, with investors pricing in the risk of tighter oil supplies that would likely weigh on economic growth.

But analysts cautioned of more volatility ahead.

"While the immediate prospect of a US intervention in Iran may have diminished, the fact this is reportedly a two-week hiatus means it will remain a live issue for the markets going into next week," said Dan Coatsworth, an investment analyst at AJ Bell.

While the Middle East crisis continues to absorb most of the news, Trump's trade war remains a major obstacle for investors as the end of a 90-day pause on his April 2 tariff blitz looms.

"While the worst of the tariffs have been paused, we suspect it won't be until those deadlines approach that new agreements may be finalized," said David Sekera, chief US market strategist at Morningstar.

"Until then, as news emerges regarding the progress and substance of trade negotiations, these headlines could have an outsize positive or negative impact on markets," he said.

- Key figures at around 2050 GMT -

Brent North Sea Crude: DOWN 2.3 percent at $77.01 per barrel

West Texas Intermediate: DOWN 0.3 percent at $74.93 per barrel

New York - Dow: UP 0.1 percent at 42,206.82 (close)

New York - S&P 500: DOWN 0.2 percent at 5,967.84 (close)

New York - Nasdaq: DOWN 0.5 percent at 19,447.41 (close)

London - FTSE 100: DOWN 0.2 percent at 7,589.66 (close)

Paris - CAC 40: UP 0.5 percent at 7,589.66 (close)

Frankfurt - DAX: UP 1.3 percent at 23,350.55 (close)

Tokyo - Nikkei 225: DOWN 0.2 percent at 38,403.23 (close)

Hong Kong - Hang Seng Index: UP 1.3 percent at 23,530.48 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,359.90 (close)

Euro/dollar: UP at $1.1516 from $1.1495 on Thursday

Pound/dollar: DOWN at $1.3444 from $1.3465

Dollar/yen: UP at 146.13 yen from 145.45 yen

Euro/pound: UP at 85.66 pence from 85.37 pence

burs-jmb/acb

R.Adler--BTB