-

Czechs greenlight magic mushroom use from 2026

Czechs greenlight magic mushroom use from 2026

-

US plans to order foreign tourists to disclose social media histories

-

Celtic boss Nancy 'won't waste time' on criticism

Celtic boss Nancy 'won't waste time' on criticism

-

What's at stake as Yemeni separatists gain ground?

-

Stocks mark time ahead of Fed decision

Stocks mark time ahead of Fed decision

-

Hollywood meets the world in Sundance line-up

-

Veggie 'burgers' remain on table as EU talks stall

Veggie 'burgers' remain on table as EU talks stall

-

French far right sparks debate with proposal to reopen brothels

-

Not lovin' it: McDonald's pulls Dutch AI Christmas ad

Not lovin' it: McDonald's pulls Dutch AI Christmas ad

-

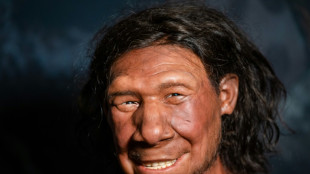

Earliest evidence of humans making fire discovered in UK

-

Evenepoel to share Red Bull lead with Lipowitz at Tour de France

Evenepoel to share Red Bull lead with Lipowitz at Tour de France

-

Austrian court rejects Ukraine tycoon's US extradition

-

Instagram users given new algorithm controls

Instagram users given new algorithm controls

-

M23's advance in DR Congo prompts uncertainty, border closure

-

'Downward spiral': French mother blames social media for teen's suicide

'Downward spiral': French mother blames social media for teen's suicide

-

US Fed expected to make third straight rate cut despite divisions

-

Daughter of Venezuela's Machado picks up Nobel peace prize in her absence

Daughter of Venezuela's Machado picks up Nobel peace prize in her absence

-

NFL to play regular season games in Munich in 2026 and 2028

-

Tens of thousands petition against Croatia Catholic men's public prayers

Tens of thousands petition against Croatia Catholic men's public prayers

-

EU seeks better Spain-France energy links after blackout

-

French special forces helped Benin after attempted coup: military

French special forces helped Benin after attempted coup: military

-

Madeleine McCann's father says 'lucky' to survive media attention

-

Sabalenka says transgender women in WTA events 'not fair'

Sabalenka says transgender women in WTA events 'not fair'

-

Gerrard urges Salah to stay at Liverpool and 'reverse away' from outburst

-

Greek govt in emergency meeting as farmers block central port

Greek govt in emergency meeting as farmers block central port

-

China consumer prices pick up pace but demand still slack

-

Venezuela's Machado 'safe' but will miss Nobel Peace Prize ceremony

Venezuela's Machado 'safe' but will miss Nobel Peace Prize ceremony

-

All Black wing Reece signs for French side Perpignan

-

Louvre thieves escaped with 30 seconds to spare, probe reveals

Louvre thieves escaped with 30 seconds to spare, probe reveals

-

Stocks retreat ahead of Fed decision

-

Not just pizza: Italian cuisine makes UNESCO list

Not just pizza: Italian cuisine makes UNESCO list

-

Spurs' Simons wants to 'build legacy' as he succeeds Son

-

Egypt switches off Liverpool after Salah fallout

Egypt switches off Liverpool after Salah fallout

-

Europe ministers meet on migration 'challenges' to rights convention

-

Real-life horror to TV drama: Feared Syria sites become sets for series

Real-life horror to TV drama: Feared Syria sites become sets for series

-

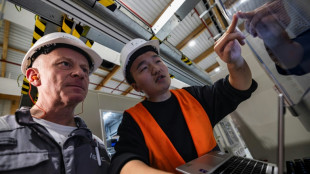

France's 'Battery Valley' makes use of Asian experts

-

Stocks in retreat as traders eye Fed decision, tech earnings

Stocks in retreat as traders eye Fed decision, tech earnings

-

Egypt teammates rally behind unsettled Salah before AFCON

-

Moo dunnit? Dog lets bull, horse into living room in Australia

Moo dunnit? Dog lets bull, horse into living room in Australia

-

Venezuela opposition chief Machado to miss Nobel Peace Prize award

-

Indian festival of lights Diwali joins UNESCO heritage list

Indian festival of lights Diwali joins UNESCO heritage list

-

Brazil lawmakers approve bill to cut Bolsonaro sentence after ruckus

-

New Zealand lose Tickner as West Indies all out for 205

New Zealand lose Tickner as West Indies all out for 205

-

China surplus pushing EU to take 'offensive' trade measures: business lobby

-

Japanese ivory trade attracts fresh global scrutiny

Japanese ivory trade attracts fresh global scrutiny

-

Tickner rushed to hospital as New Zealand bowl out West Indies for 205

-

Cambodia-Thailand border clashes send half a million into shelters

Cambodia-Thailand border clashes send half a million into shelters

-

Cambodia pull out of SEA Games in Thailand over border conflict

-

Orlando to face New York in NBA Cup semis at Vegas

Orlando to face New York in NBA Cup semis at Vegas

-

Cambodia pull out of SEA Games in Thailand: organisers

Stocks retreat ahead of Fed decision

Stock markets mostly fell and the dollar steadied Wednesday following a tepid day on Wall Street as investors bided their time ahead of a highly anticipated Federal Reserve policy announcement later in the day.

London managed a slight rise, while most European markets slipped around midday after a lacklustre session in Asia.

With US central bankers expected to cut interest rates for the third straight session on Wednesday, the main focus is on their post-meeting statement, Fed boss Jerome Powell's news conference and the "dot plot" forecast for 2026 policy.

"While there is a 90 percent chance of a rate cut at this meeting, the outlook is less clear," said Kathleen Brooks, research director at traders XTB.

"In the lead up to this meeting, bond traders are scaling back their expectations for future rate cuts, with only two further reductions expected throughout 2026," she added.

After November's tech-led swoon, stock markets have enjoyed a healthy run in recent weeks as weak jobs figures reinforced expectations for another step lower in borrowing costs.

But that has cooled heading into the Fed gathering following the release of US inflation data that was slightly higher than expected.

US data on Tuesday showing an uptick in job openings -- against estimates for a drop -- further tempered expectations for a string of cuts next year.

Still, there is some hope that the Fed will turn more dovish next year with US President Donald Trump's top economic aide Kevin Hassett -- the frontrunner to succeed Powell in May -- saying he sees plenty of room to substantially lower rates.

After a weak showing Tuesday in New York, where the S&P 500 and Dow dropped, Asia fared no better Wednesday.

Tokyo, Sydney, Singapore, Seoul, Mumbai, Wellington, Jakarta and Manila all fell, though Hong Kong and Taipei edged up.

Shanghai dropped even as data showed China's consumer prices rose last month at their fastest pace in almost two years, following an extended period of deflationary pressure in the world's second-largest economy.

The price of silver hit a record high at $61.6145 an ounce owing to high demand for the metal used by industry as well as for making jewellery.

It topped $60 for the first time Tuesday also thanks to supply constraints.

Investors are also keenly awaiting earnings from software giant Oracle and chipmaker Broadcom, which will be used to judge the outlook for the tech sector in the wake of huge investments in artificial intelligence.

Markets have been pumped higher for the past two years by the surge into all things AI, though there has been some concern of late that the hundreds of billions splashed out might not see returns as early as hoped.

- Key figures at around 1100 GMT -

London - FTSE 100: UP 0.1 percent at 9,649.85 points

Paris - CAC 40: DOWN 0.5 percent at 8,013.40

Frankfurt - DAX: DOWN 0.5 percent at 24,035.46

Tokyo - Nikkei 225: DOWN 0.1 percent at 50,602.80 (close)

Hong Kong - Hang Seng Index: UP 0.4 percent at 25,540.78 (close)

Shanghai - Composite: DOWN 0.2 percent at 3,900.50 (close)

New York - Dow: DOWN 0.4 percent at 47,560.29 (close)

Dollar/yen: DOWN at 156.77 yen from 156.90 yen on Tuesday

Euro/dollar: UP at $1.1631 from $1.1630

Pound/dollar: UP at $1.3307 from $1.3300

Euro/pound: DOWN at 87.40 pence from 87.43 pence

Brent North Sea Crude: UP 0.2 percent at $62.08 per barrel

West Texas Intermediate: UP 0.3 percent at $58.44 per barrel

K.Thomson--BTB