-

Napoli beat Milan in Italian Super Cup semi-final

Napoli beat Milan in Italian Super Cup semi-final

-

Violence erupts in Bangladesh after wounded youth leader dies

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

US hosting new Gaza talks to push next phase of deal

-

Chicago Bears mulling Indiana home over public funding standoff

Chicago Bears mulling Indiana home over public funding standoff

-

Trump renames Kennedy arts center after himself

-

Trump rebrands housing supplement as $1,776 bonuses for US troops

Trump rebrands housing supplement as $1,776 bonuses for US troops

-

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

-

Trump signs order reclassifying marijuana as less dangerous

Trump signs order reclassifying marijuana as less dangerous

-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

US accuses S.Africa of harassing US officials working with Afrikaners

US accuses S.Africa of harassing US officials working with Afrikaners

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

-

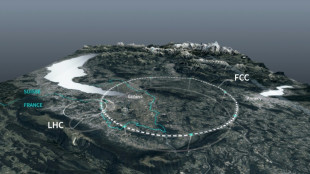

Private donors pledge $1 bn for CERN particle accelerator

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

Not enough evidence against Swedish PM murder suspect: prosecutor

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

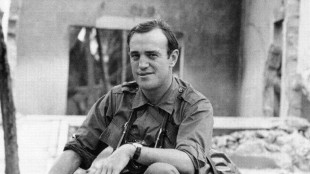

Pulitzer-winning combat reporter Peter Arnett dies at 91

Asian markets drop as Fed minutes cause fresh rate hike woe

Markets dropped in Asia on Thursday following a sell-off in New York spurred by minutes from the Federal Reserve indicating officials intended to keep lifting interest rates to tackle decades-high inflation.

While policymakers said they would eventually have to start tempering their tightening pace, they said they would keep borrowing costs elevated "for some time," though admitted there was a risk of going too far and damaging the economy.

The minutes dampened hopes that after a period of quick, sharp increases this year, the bank could possibly begin lowering them in 2023 once inflation was coming down.

Bets on a more dovish approach in the new year had been boosted by data showing inflation came down quicker in July than expected. That helped drive a rally in equities from their June lows and weighed on the dollar.

However, the realisation that policy would likely stay restrictive undermined the sense of optimism, pushing all three indexes on Wall Street down Wednesday for the first time in four days with the tech-heavy Nasdaq taking the biggest hit.

And news that UK inflation spiked above 10 percent for the first time since 1982 added to the downbeat mood.

In Asia, traders appeared increasingly worried that the Fed will slip up as it tries to bring down inflation without causing another recession in the world's biggest economy.

Tokyo, Hong Kong, Sydney, Shanghai, Seoul, Taipei, Wellington and Manila were all well down.

"While the... minutes continue to emphasise the need to contain inflation, there is also an emerging concern the Fed could tighten more than necessary," Christopher Low, of FHN Financial, said.

"There is an inkling of improvement on the supply side of the economy, there is a bit of hope in some product prices moderating, but there is still a great deal of concern about inflation and inflation expectations."

JP Morgan Asset Management's Meera Pandit told Bloomberg Television: "We do still anticipate there's going to be a lot of interest-rate volatility in the back half of the year, especially once markets start to perhaps acknowledge the fact that we might not necessarily see cuts in 2023 that are being priced in."

Sentiment was also dragged by continuing worries about China's economy, with Goldman Sachs and Nomura slashing their growth outlooks again following another weak round of data and as the country reels from Covid-19 lockdowns.

The announcements came after Beijing on Monday cut interest rates in a surprise move, before Premier Li Keqiang called on six key provinces -- accounting for about 40 percent of the economy -- to bolster pro-growth policies.

But Nomura economists said that while officials will likely unveil further measures "rolling out a comprehensive stimulus package is of low probability in a year of government reshuffle, while the need for maintaining zero-Covid makes conventional stimulus measures much less effective".

- Key figures at around 0250 GMT -

Tokyo - Nikkei 225: DOWN 0.8 percent at 28,984.56 (break)

Hong Kong - Hang Seng Index: DOWN 0.6 percent at 19,805.16

Shanghai - Composite: DOWN 0.6 percent at 3,272.85

Euro/dollar: UP at $1.0182 from $1.0178 Wednesday

Pound/dollar: DOWN at $1.2046 from $1.2050

Euro/pound: UP at 84.52 pence from 84.44 pence

Dollar/yen: DOWN at 134.86 yen from 135.08 yen

West Texas Intermediate: DOWN 0.2 percent at $87.96 per barrel

Brent North Sea crude: DOWN 0.1 percent at $93.57 per barrel

New York - Dow: DOWN 0.5 percent at 33,980.32 (close)

London - FTSE 100: DOWN 0.3 percent at 7,515.75 (close)

K.Brown--BTB